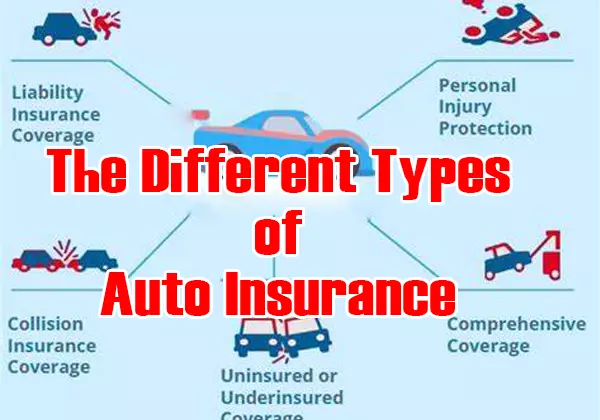

Auto insurance is required by law in most states, but there are many different types of coverage available. Here is a guide to the different types of auto insurance and what they cover.

- Liability insurance

- Collision insurance

- Comprehensive insurance

- Uninsured/underinsured motorist insurance

- Personal injury protection (PIP)

- Gap insurance

Auto insurance is an important aspect of owning a vehicle. Not only is it required by law in most states, but it can also provide financial protection in case of an accident or other unexpected event. However, there are many different types of auto insurance available, and it can be confusing to know what coverage you need. Here is a guide to the different types of auto insurance and what they cover:

Liability insurance:

Liability insurance is required by law in most states and covers damages or injuries that you may cause to others while driving. It includes two types of coverage: bodily injury liability and property damage liability.

Collision insurance:

Collision insurance covers damages to your vehicle if you are involved in an accident with another vehicle or object. It can help pay for repairs or the replacement of your vehicle.

Comprehensive insurance:

Comprehensive insurance covers damages to your vehicle from non-collision events, such as natural disasters, theft, or vandalism.

Uninsured/underinsured motorist insurance:

This type of insurance provides protection if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Personal injury protection (PIP):

PIP insurance covers medical expenses and lost wages for you and your passengers if you are involved in an accident, regardless of who is at fault.

Gap insurance:

If you have a leased vehicle or a vehicle that is being financed, gap insurance can cover the difference between the value of the vehicle and the amount you owe on it.

Remember, the specific types of auto insurance you need will depend on your individual situation. It’s important to consult with an insurance professional to determine the coverage that is right for you.